Order Flow Trading

All The Order Flow Features You Need

-- In One Platform

Extensive and customizable Order Flow tools make it easy for you to analyze trading activity using volume, order flow and depth of market.

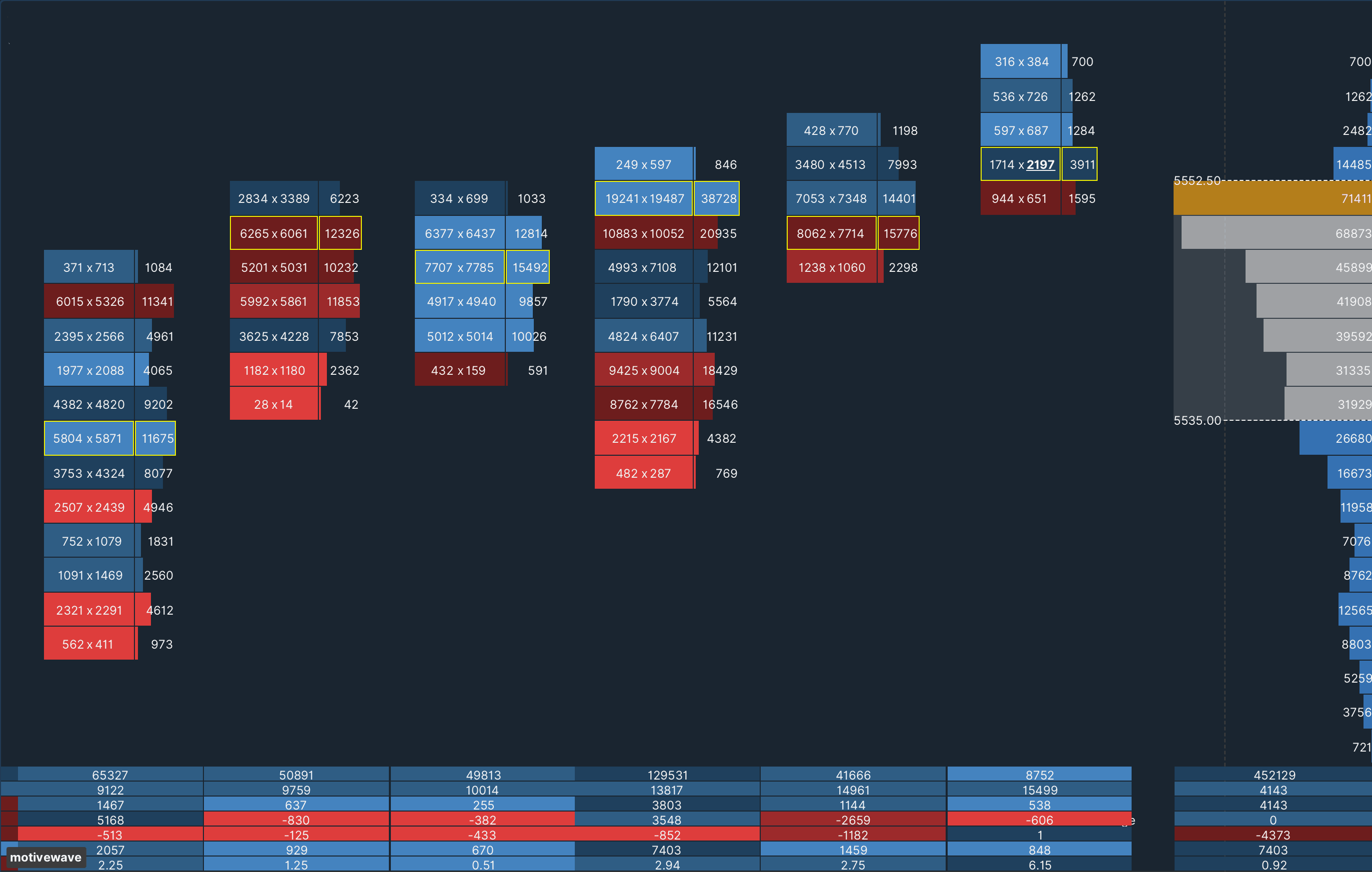

Volume Imprint (Footprint Charts)

Volume Imprint provides several ways to look at volume and how it relates to price. This study uses historical tick data to segment volume into price intervals. Each price interval divides the volume into bid volume and ask volume.

There are currently 5 different types of display candles: Profile, Bid/Ask, Ladder, Delta, and Volume.

The Volume Imprint Study is included in our Order Flow Studies Pack.

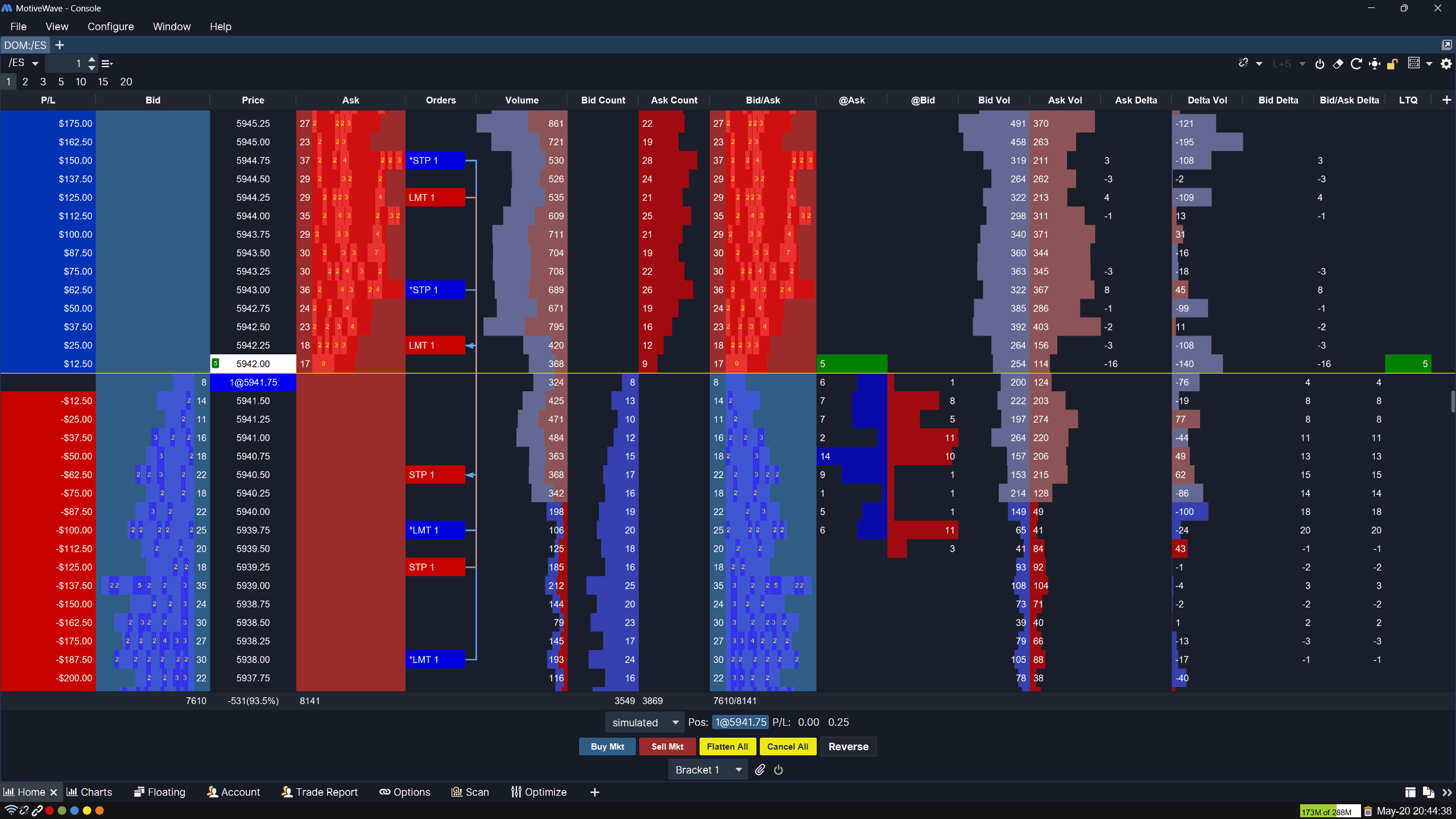

Depth of Market (DOM)

The Depth of Market (DOM) shows the number of resting (limit) buy and sell orders. It can also display other columns such as trades recently executed, orders being added or pulled, and volume traded at each price level.

- Highly customizable DOM

- Add/Remove DOM Columns

- Set custom Exit Strategies

- Create DOM Templates

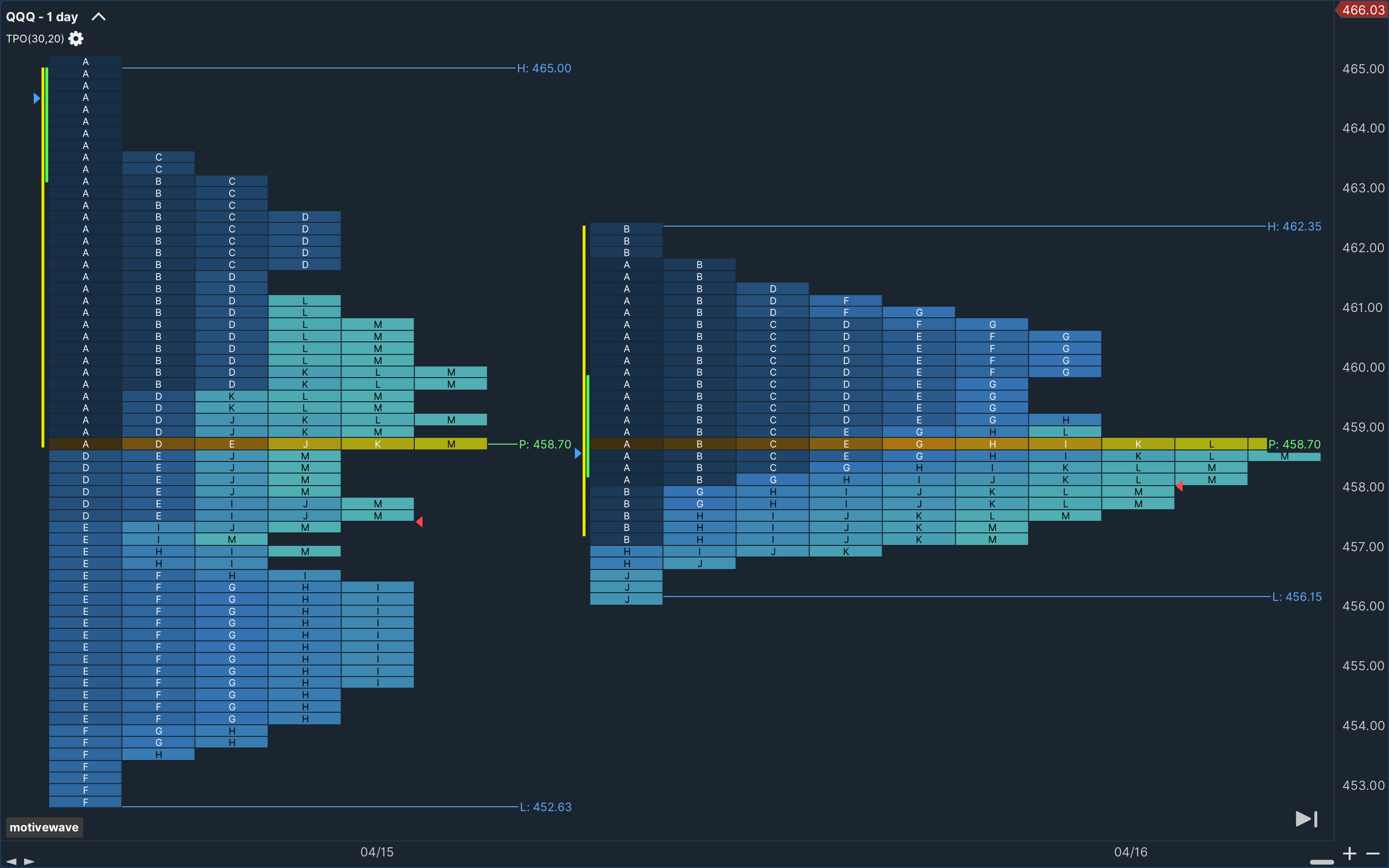

Time Price Opportunity (TPO)

The TPO Study displays market activity using time and price (sometimes known as Market Profile). It plots the difference between the Bid/Ask Volume as it accumulates throughout the trading day.

An additional TPO Component offers a convenient way to drag/drop a TPO onto a chart and dynamically adjust the range.

The TPO Study is included in our Order Flow Studies Pack.

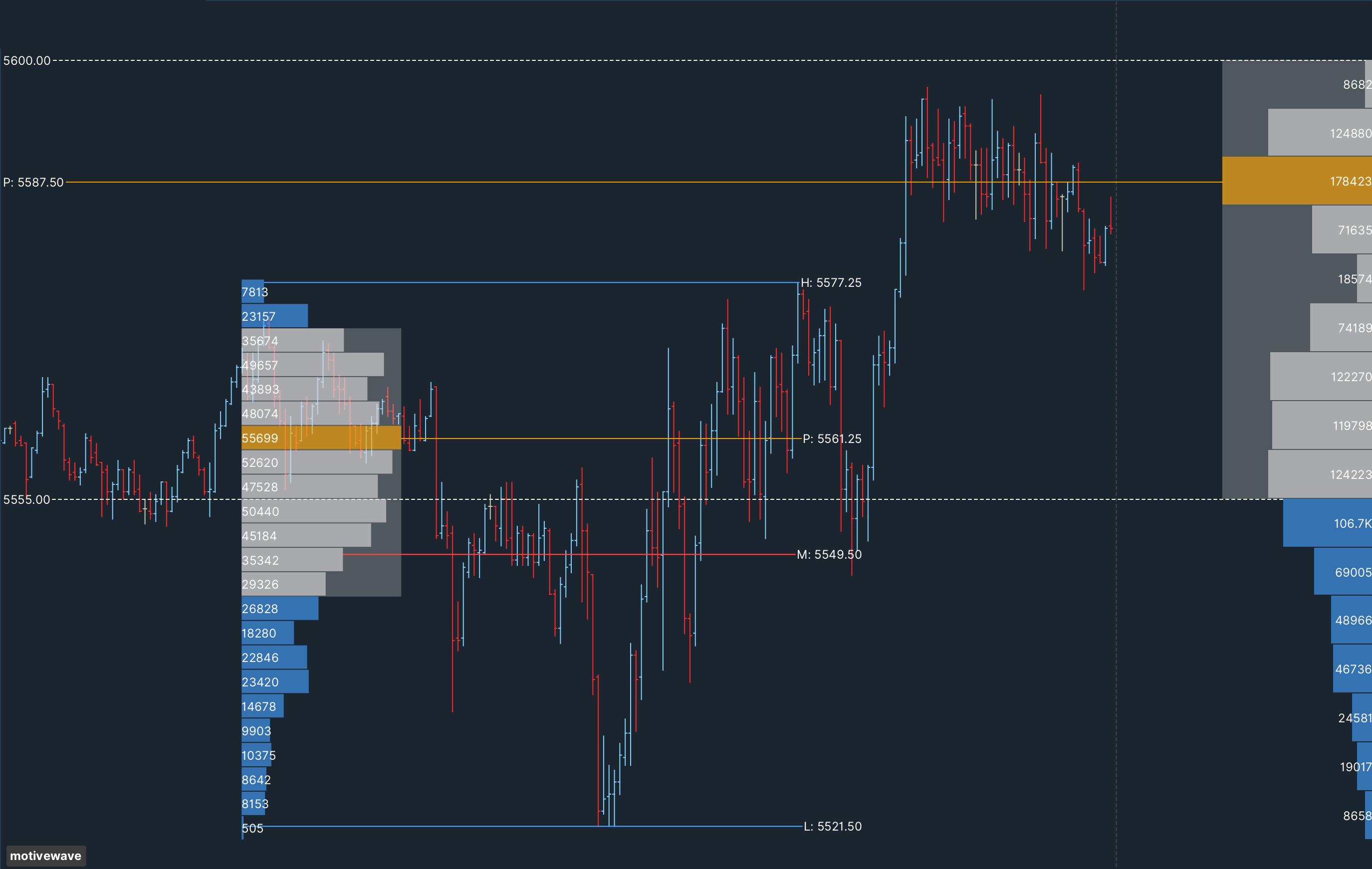

Volume Profile Study & Component

The Volume Profile Study displays the distribution of volume traded at each price for a given period, identifying key support and resistance levels. The optional component allows you to drag/drop a profile and dynamically adjust its range.

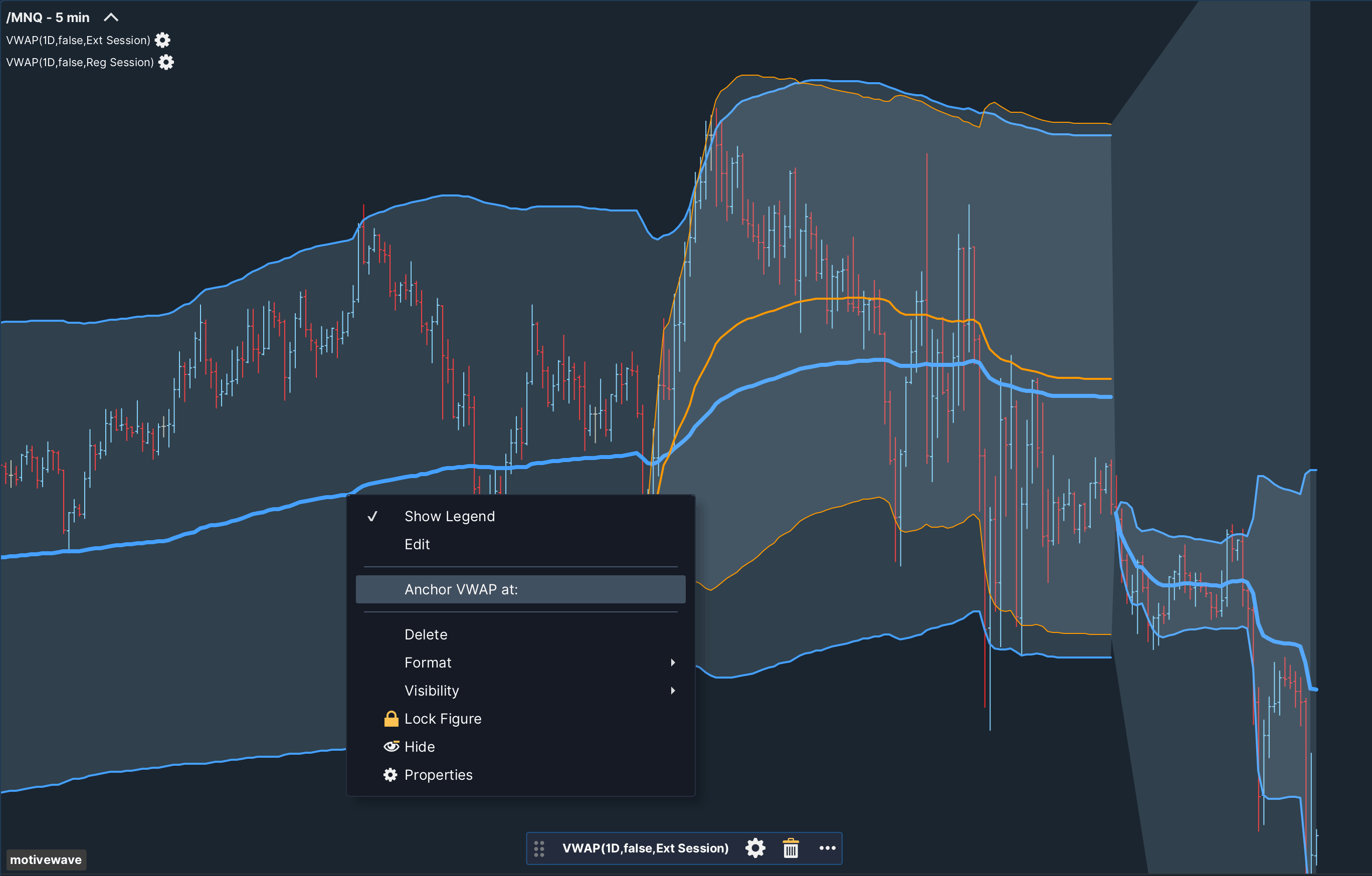

VWAP (Volume Weighted Average Price)

The VWAP Study uses historical tick data to calculate the average price weighted by volume. You can set up to 3 Standard Deviation Bands and use Anchors to set the starting point for the calculation.

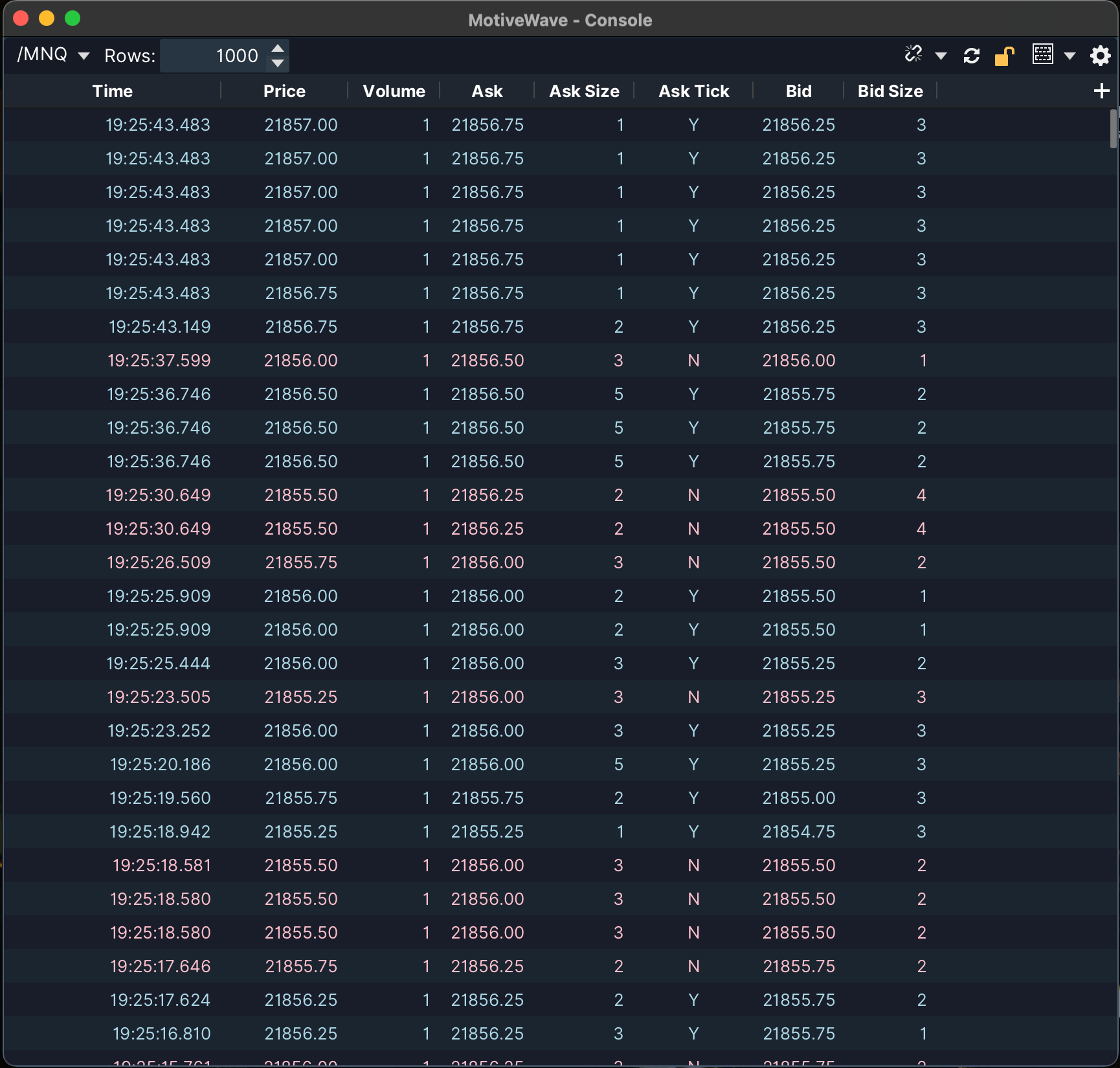

Time and Sales

Time & Sales (reading the tape) shows a real-time display of the time, price, and volume of each trade. This tells you if there are currently more buyers or sellers, and what prices they are trading at.

Order Flow Studies Pack

The 11 studies highlighted on this page are part of the Order Flow Studies Pack, included in our Order Flow, Professional, and Ultimate Editions.

- Bid/Ask Volume

- Big Trades Study

- Cumulative Delta

- Delta Volume

- Depth of Market

- DOM History

- DOM Power

- Speed Gauge

- Speed of Tape

- Time Price Opportunity (TPO)

- Volume Imprint

Additional Volume-Based Studies

MotiveWave has many more volume-based studies included in ALL of our editions.

- Accumulation/Distribution Line

- Better Volume

- Daily Volume Profile

- Ease of Movement

- Elastic Volume Weighted MA

- Herrick Payoff Index

- Klinger Volume Oscillator

- On Balance Volume

- Open Interest

- Positive Volume Index

- Relative Volume

- UpSide DnSide Volume

- Volume

- Volume Oscillator

- Volume Price Trend

- Volume Rate of Change

- VWAP (included)

- Volume Weighted Moving Average (VWMA)

- Volume Zone Oscillator

See More Details In The Guide

Join Over 50,000 Registered Users Around The World

Take our no obligation, risk-free 14 day free trial of our MotiveWave trading platform. You'll have full access to all of our trading software features found in the Ultimate Edition during the trial. We do not ask for any credit card information.

TAKE OUR RISK-FREE, 14 DAY FREE TRIAL NOW