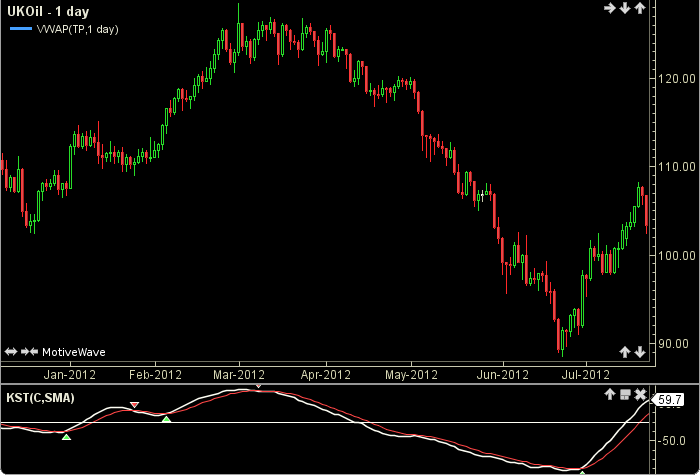

Know Sure Thing

Know Sure Thing was developed by Martin J. Pring in the 1990s. The KST uses four rate of change values to determine the trend of the market. The user may change the input (close), methods (SMA, EMA) and multiple period lengths. This indicator’s definition is further expressed in the condensed code given in the calculation below.

How To Trade Using Know Sure Thing

If the KST crosses above the SIGNAL line a buy signal will be generated. Conversely, if the KST crosses below the SIGNAL line a sell signal will be given.

How To Access in MotiveWave

Go to the top menu, choose Study>General>Know Sure Thing

or go to the top menu, choose Add Study, start typing in this study name until you see it appear in the list, click on the study name, click OK.

Important Disclaimer: The information provided on this page is strictly for informational purposes and is not to be construed as advice or solicitation to buy or sell any security. Please see our Risk Disclosure and Performance Disclaimer Statement.

Calculation

//input = price, user defined, default is closing price

//method1 = moving average (ma), user defined, default is SMA

//method2 = moving average (ma), user defined, default is EMA

//signalPeriod = user defined, default is 8

//ma1 default = 10, r1 default = 10, w1 default = 1

//ma2 default = 10, r2 default = 15, w1 default = 2

//ma3 default = 10, r3 default = 20, w1 default = 3

//ma4 default = 15, r4 default = 30, w1 default = 4

//index = current bar number, roc = rate of change

roc1 = roc(index, r1, input)*100);

roc2 = roc(index, r2, input)*100);

roc3 = roc(index, r3, input)*100);

roc4 = roc(index, r4, input)*100);

KST = ma(method1, index, ma1, ROC1)*w1 + ma(method1, index, ma2, ROC2)*w2 +

ma(method1, index, ma3, ROC3)*w3 + ma(method1, index, ma4, ROC4)*w4;

SIGNAL = ma(method2, index, signalPeriod, KST);

//Signals

buy = crossedAbove(KST, SIGNAL);

sell = crossedBelow(KST, SIGNAL);