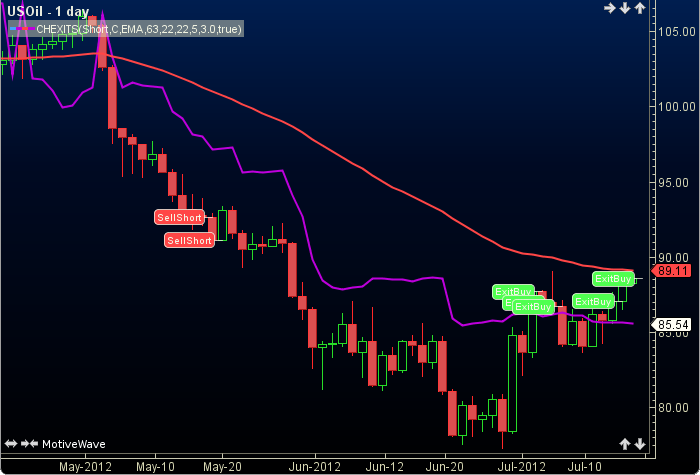

Chandelier Exits

Chandelier Exits (CE) was authored, by Chuck LeBeau. CE identifies stop loss exit points for long or short positions. Optional entry points are also displayed. CE uses an exponential moving average to determine the current trend; then the average true range times a user defined factor is either, depending upon the trend, added or subtracted from the highest high or lowest low. The user may change the position (long), input (close), method (EMA), period lengths, look back, factor and show entry option. This indicator’s definition is further expressed in the condensed code given in the calculation below.

How To Trade Using Chandelier Exits

Chandelier Exits are designed to aid in stop loss exit decisions. However entry points are optionally provided. These are based on five consecutive increases in an uptrend (buy) or five consecutive decreases in a down trend (sell).

How To Access in MotiveWave

Go to the top menu, choose Study>Exits>Chandelier Exits Stops

or go to the top menu, choose Add Study, start typing in this study name until you see it appear in the list, click on the study name, click OK.

Important Disclaimer: The information provided on this page is strictly for informational purposes and is not to be construed as advice or solicitation to buy or sell any security. Please see our Risk Disclosure and Performance Disclaimer Statement.

Calculation

//position = pos, user defined, default is long

//input = price, user defined, default is close

//method = moving average (ma), user defined, default is EMA

//period1 = maP, user defined, default is 63

//period2 = upP, user defined, default is 22

//period3 = dnP, user defined, default is 22

//look back = lb, user defined, default is 5

//factor = fac, user defined, default is 3

//show entry = showE, user defined boolean, default is false

//index = current bar number, prev = previous

//shortP = short position, longP = long position

//index = current bar number

ma = ma(method, index, maP, key);

prevP = price[index-1];

upTrend = price moreThan ma;

dnTrend = price lessThan ma;

if (upTrend)

atrUp = atr(index, upP);

highest = highest(index, upP, HIGH);

chand = highest - fac * atrUp;

endIf

if (dnTrend)

atrDn = atr(index, dnP);

lowest = lowest(index, dnP, LOW);

chand = lowest + fac * atrDn;

endIf

Plot: chand;

//Signals

lowFive = false;

for (i = -(lb-1); i lessOr=0; i++)

cP = price[index+i];

prevP = price[index+i-1];

cMa = MA[index+i];

pMa = MA[index+i-1];

lowFive = (cP lessThan prevP AND cP lessThan cMa AND prevP lessThan pMa);

if (!lowFive) break;

endFor

highFive = false;

for (i = -(lb-1); i lessOr=0; i++)

cP = price[index+i];

prevP = price[index+i-1];

cMa = MA[index+i];

pMa = MA[index+i-1];

highFive = (cP moreThan prevP AND cP moreThan cMa AND prevP moreThan pMa);

if (!highFive) break;

endFor

sell = false, buy = false;

if (chand != 0)

if (longP AND upTrend)

sell = prevP moreThan chand AND price lessThan chand; //sell to exit

buy = highFive AND showE; //buy

endif

if (shortP AND dnTrend)

sell = lowFive AND showE; //sell short

buy = prevP lessThan chand AND price moreThan chand; //buy to cover

endIf

endIf