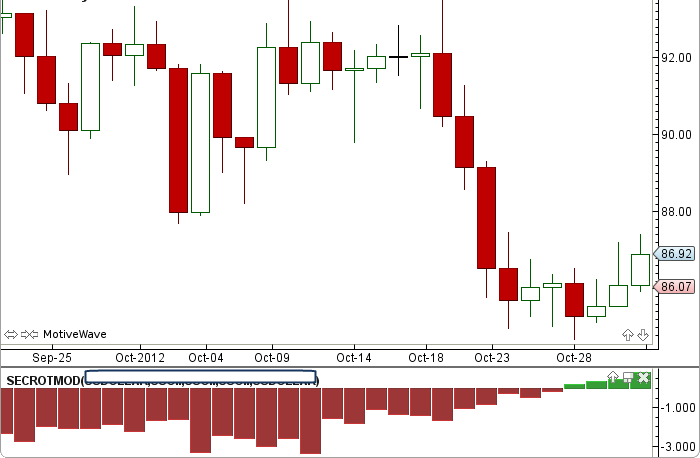

Sector Rotation Model

Sector Rotation Model was authored by Giorgos Siligardos in the Stocks and Commodities Magazine, August 2012. Select daily bars only. S&P500 Exchange Traded Funds (ETF’s) Instruments are used as proxies for different sectors: XLF for the financial (bull) sector, XLY for the consumer discretionary (bull) sector, XLE for the energy (bear) sector, XLP for the consumer staples (bear) sector, XLU for the utilities (bear) sector. The Rate of Change (ROC) for each sector is used to form a bullish or bearish value. The difference of these values is plotted as an oscillator. The user may change the input (close), period (75), period length and instruments. This indicator’s definition is further expressed in the condensed code given in the calculation below.

How To Trade Using the Sector Rotation Model

No trading signals are calculated for this indicator.

How To Access in MotiveWave

Go to the top menu, choose Add Study, start typing in this study name until you see it appear in the list, click on the study name, click OK.

Important Disclaimer: The information provided on this page is strictly for informational purposes and is not to be construed as advice or solicitation to buy or sell any security. Please see our Risk Disclosure and Performance Disclaimer Statement.

Calculation

//input = price, user defined, default is closing price

//rocPeriod = user defined, default is 75

//instr1 = for financial sector use SP500 XLF

//instr2 = for consumer discretionary sector use SP500 XLY

//instr3 = for energy sector use SP500 XLE

//instr4 = for utilities sector use SP500 XLU

//instr5 = for consumer staples sector use SP500 XLP

//index = current bar number

bull01 = roc(index, period, input, instr1);

bull02 = roc(index, period, input, instr2);

bear01 = roc(index, period, input, instr3);

bear02 = roc(index, period, input, instr4);

bear03 = roc(index, period, input, instr5);

bear = (bear01 + bear02 + bear03) / 3;

bull = (bull01 + bull02) / 2;

Plot: osc = 100 * (bull - bear);

if (upColor.isEnabled() AND osc moreOrEqual 0)

setBarColor(index, OSC, upColor);

endIf

if (downColor.isEnabled() AND osc lessOrEqual; 0)

setBarColor(index, OSC, downColor);

endIf